Property rates are raised each financial year.

The rates that are raised contribute towards the cost of maintaining local assets, infrastructure and delivering high-quality services for the community for the coming year. You can find out more about this on our What your rates pay for page.

Ratepayers will receive their rates notice late July into early August each year. If you need a new copy of the current rates notice, or a copy of an old rates notice, you can request this by emailing [email protected] or by calling us on (03) 9278 4444.

Rate capping

The State Government sets the rate cap and how much councils can collect each year.

We have complied with the State Government’s rates cap of 2.75%. The cap does not apply to individual rate notices, but applies to the average annual increase of the general rate. Most properties experience rate increases that are slightly higher or lower than the rate cap, depending on their evaluation.

Your rate notice may also include rates and charges not covered by the State Government’s rate cap, such as the Waste management charge.

How rates are calculated

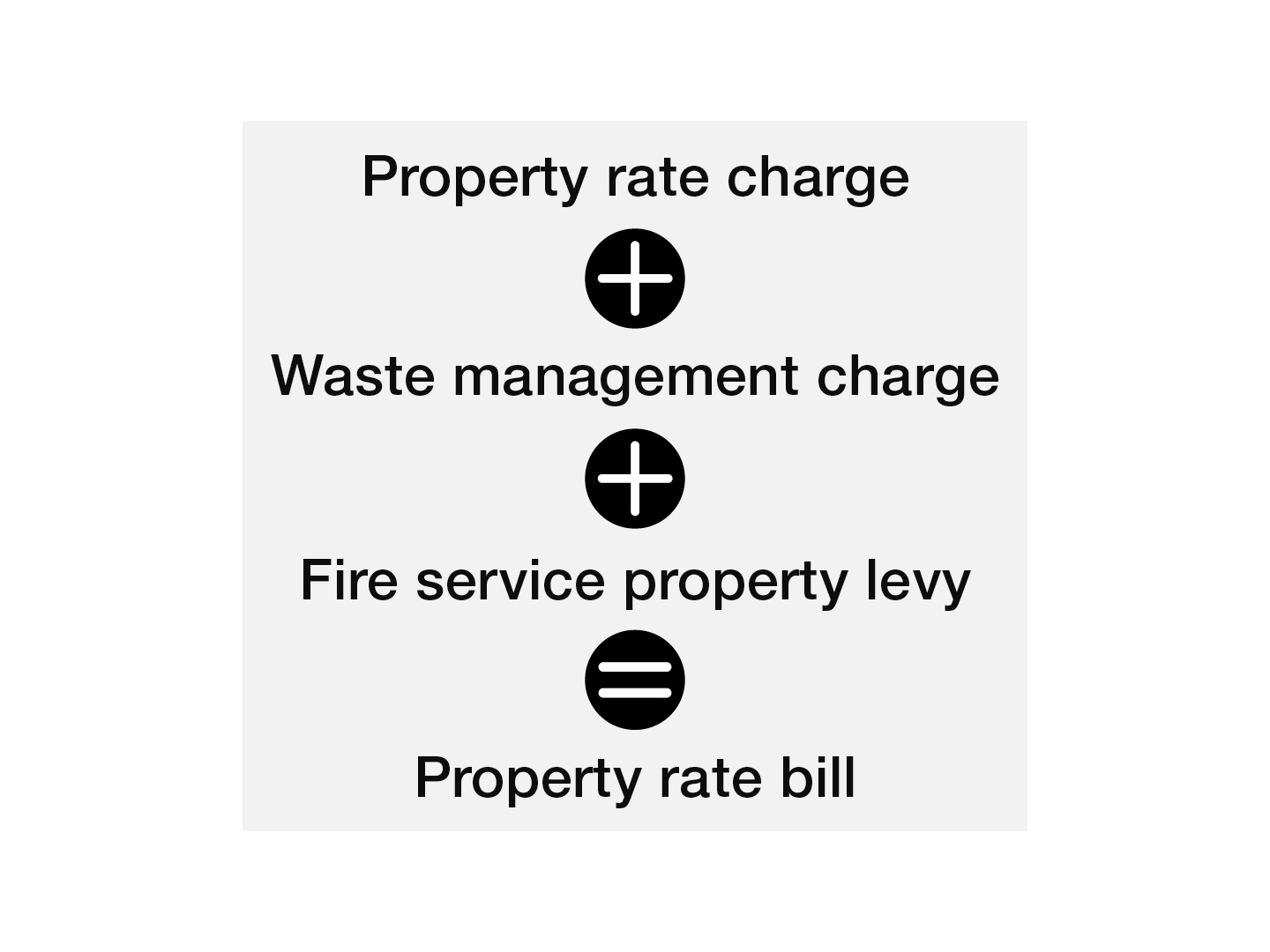

Each property rates bill is made up of the property rates charge, Waste management charge, and the Fire Services Property Levy.

We calculate your rates based on Capital Improved Value (CIV), which is the total market value of your land, buildings, and other improvements. Your property is valued each year by the Valuer-General Victoria to determine your CIV.

Your property rates may have increased or decreased by a different percentage amount based on the valuation of your property, relative to the valuation of other properties in the municipality.

The latest CIV was adopted in 2024 and applies to all properties in Boroondara.

How we calculate your property rates bill

There are 4 steps we follow to calculate your property rates bill:

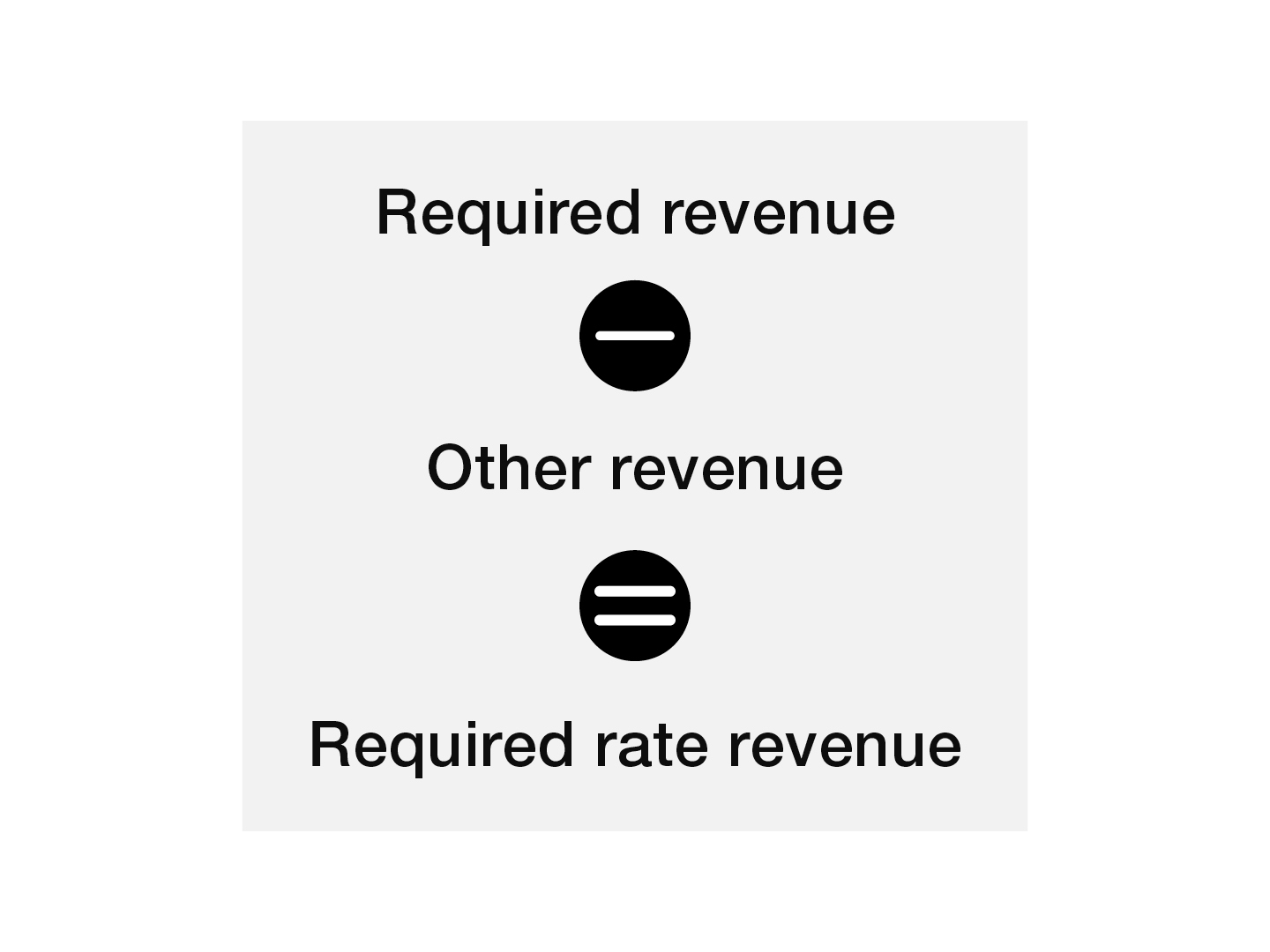

Step 1: Find the rate revenue required

First, we work out the amount of rate revenue required to support Council services and infrastructure for our community.

For 2024-25 we need $183,269,653 of rates revenue.

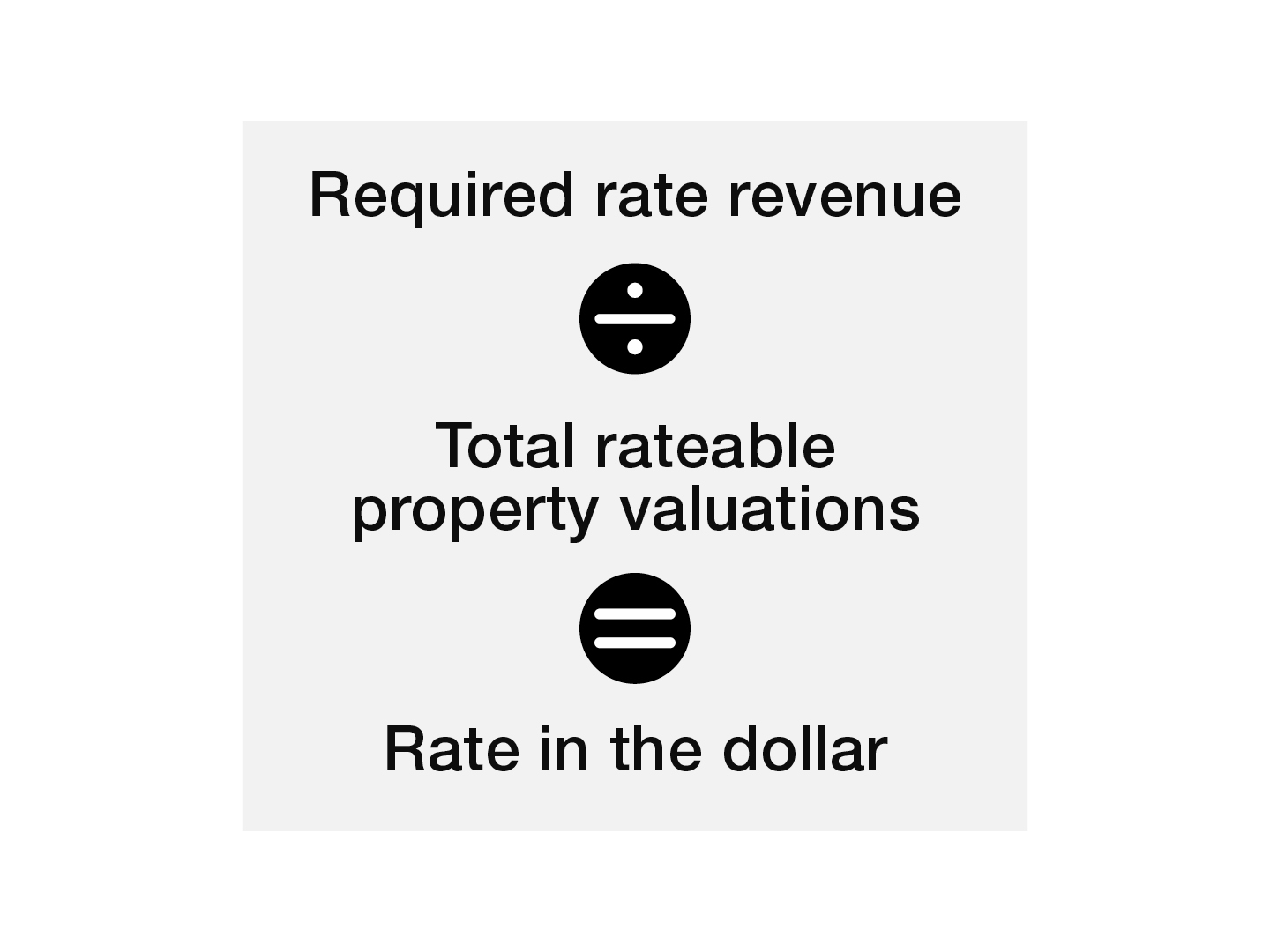

Step 2: Work out the rate in the dollar

Next, we use the required rate revenue to find the ‘rate in the dollar’. For this we need the value of all properties that pay rates in Boroondara. The total value of all rateable properties for 2024-25 is $142,886,395,000.

We find the ‘rate in the dollar’ by dividing the required rate revenue by the total rateable property valuations. For 2024-25, this is 0.0012826249.

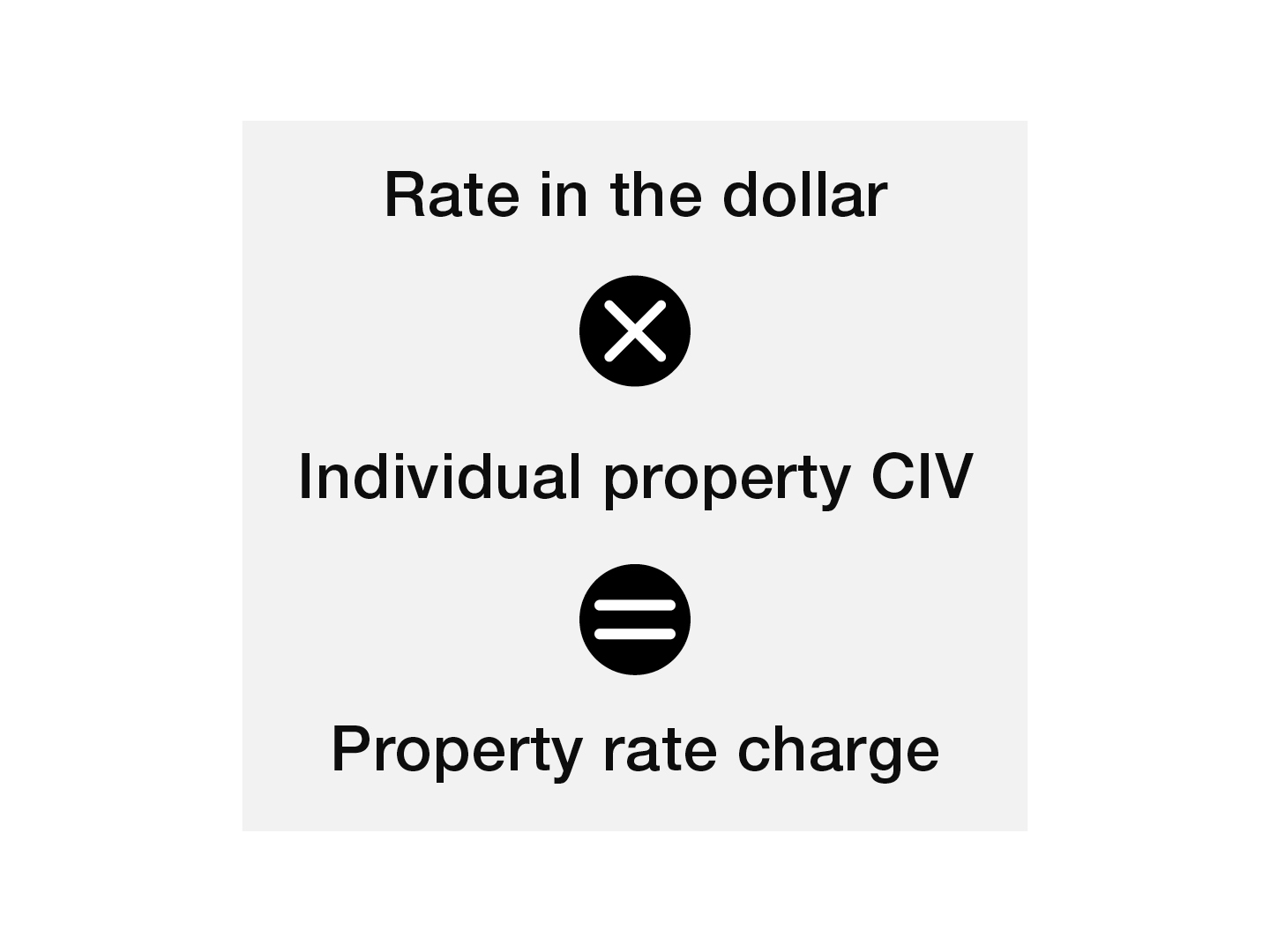

Step 3: Calculate your general rates

We don’t each pay the same rates. Instead, we pay an amount determined by the value of our property.

For step 3 we multiply the ‘rate in the dollar’ by the Individual property CIV to find the property rate charge.

Step 4: Calculate your rates and charges

Lastly, we add in your waste management charge and Fire Services Property Levy, and subtract any Pension concessions. This works out your total property rate bill.

Example of property rate charge calculations

As an example, if your individual property CIV is judged to be $1,600,000, then on your property rate bill your property rates charge will be $2,052.20. We calculate this amount by multiplying the ‘rate in dollar’ amount (0.0012826249) by your Individual property CIV. We find the ‘rate in the dollar’ by dividing our required rate revenue for the year ($183,269,653) by the total rateable property valuations ($142,886,395,000).

Waste management charge

We set this charge to cover the costs of all waste services, including collecting your bins. It also covers cleaning and waste management in public areas, such as street sweeping and public bins.

The State Government’s landfill levy is also included in your waste charge. All councils pay this levy to cover the cost of disposing waste into landfill. The funds are transferred to the State Government’s Sustainability Fund.

We calculate your waste management charge by multiplying the number of bins on your property by the cost for the type of bins on the property.

Fire Services Property Levy

The Fire Services Property Levy is collected in your rates on behalf of the State Government. This funds the Metropolitan Fire Brigade and the Country Fire Authority (CFA).

The levy (residential) for a property is calculated by multiplying the property’s CIV by the levy amount.

The Fire Services Property Levy is not subject to rate capping and the amount is determined by the State Government. For more information, see the State Revenue Office Victoria website.

Objecting to a valuation

If you wish to object to the Valuer-General Victoria’s valuation of your property, you can lodge an objection with the Valuer-General Victoria within 2 months of the issue date of your valuation and rates notice. You can lodge an objection on the Victorian Government’s Rating valuation objections website.